119th Congress Legislative Priorities

NLBMDA Legislative Wins in One, Big, Beautiful, Bill (OBBB)

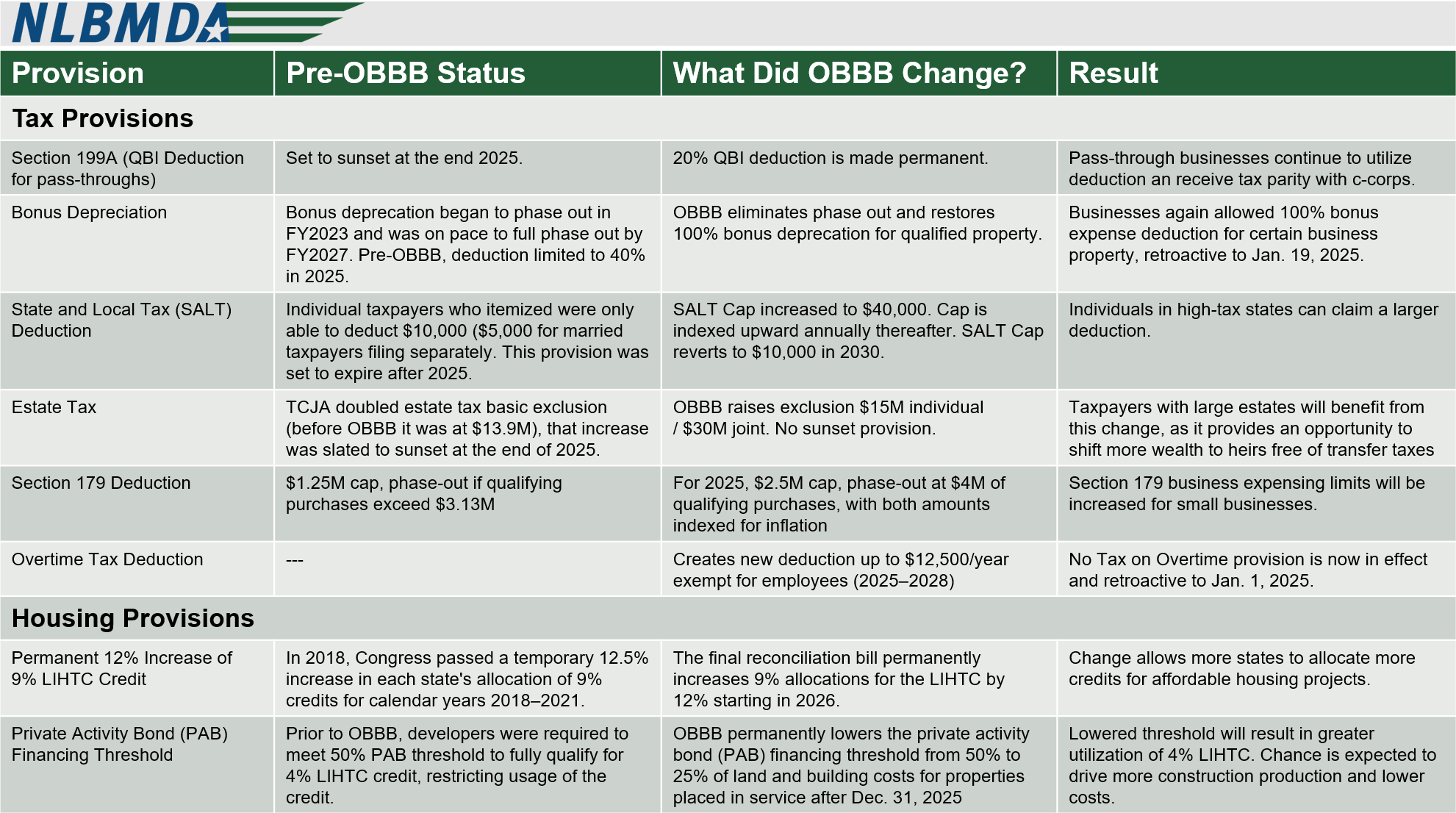

NLBMDA secured a series of legislative wins this year, ensuring the LBM industry’s voice remained front and center as Congress debated one of the most consequential tax and spending bills in over a decade. Several priorities that NLBMDA advocated for through years of engagement with Congressional offices were included in the final package. Key victories include securing full expensing permanence, allowing LBM dealers to immediately deduct qualifying purchases in the year they are made; maintaining the Section 199A deduction, which ensures pass-through entities receive equitable tax treatment with C-corporations; strengthening the State and Local Tax deduction; raising and making permanent the estate tax exemption; and expanding the Section 179 expensing deduction. In addition, NLBMDA successfully advanced changes to 529 savings plans so they can be utilized for non-4-year degree education opportunities a move that will help promote workforce growth in the LBM and residential construction industry. NLBMDA also worked to advance historic investments in housing through the expansion of the low-income housing tax credit (LIHTC), a valuable tool used by housing developers across the country to construct affordable housing units. The provisions included in the final tax and spending bill are estimated to lead to the production of an additional one-million housing units over the next decade.

Supporting LBM Dealer Growth

Credit Card Competition Act of 2025

The Issue: For many LBM dealers credit card swipe fees have risen to become the second highest operating expense only behind labor. Currently, Visa and Mastercard set the swipe fees charged by banks that issue their credit cards and block transactions from being processed over other networks that could do the same job with lower fees. There are a dozen competitive networks that could process credit card transactions, but Visa and Mastercard have blocked them from entering the market. Swipe fee revenues have more than doubled over the past decade and soared to a record $187 billion in 2024, up from $172 billion in 2023 and $160 billion in 2022.

The Legislation: The Credit Card Competition Act of 2025 (CCCA) is a bipartisan bill that addresses excessive credit card swipe fees for small businesses by allowing access to more credit card payment network options. Championed by Sens. Roger Marshall (R-KS) and Richard Durin (D-IL), this bill requires the nation’s largest financial institutions to allow any credit cards they issue to be processed over at least two unaffiliated networks – Visa or Mastercard plus a competitor like NYCE, Star, Shazam or Discover. NLBMDA is asking House and Senate lawmakers to cosponsor and pass the Credit Card Competition Act upon its imminent reintroduction to protect America’s small businesses against excessive credit card fees.

NLBMDA Actions: Since CCCA was first introduced in the 117th Congress, NLBMDA has been a leading advocate for the bill on Capitol Hill. For the last three years the legislation has been a centerpiece for NLBMDA’s spring legislative fly-in. Through our partnership with the Merchant Payments Coalition, NLBMDA routinely joins industry partners on Capitol Hill to meet with lawmakers to build support for the legislation.

Current Status: In 2025, the Senate advanced the GENIUS Act, legislation that attempts to regulate the cryptocurrency stablecoin market. The legislation is the first banking bill to reach the Senate floor since the CCCA was originally introduced in the 117th Congress. Through Senate regular order, lawmakers are able to propose amendments to the bill, opening up an opportunity Sens. Marshall and Durbin to file the CCCA as an amendment.

On May 20th, Sen. Marshall officially filed the Marshall-Durbin amendment, effectively the CCCA in amendment form. NLBMDA was active on Capitol Hill meeting with Senate offices to build support for the amendment. Ultimately, Republican Senate Leadership opted to advance the bill outside of regular order, an increasing common practice in Washington, unfortunately blocking the ability for the CCCA or any other amendment to be voted on. Sens. Marshall and Durbin are likely to reintroduce CCCA as a stand-alone piece of legislation shortly. NLBMDA, in partnership with our coalition partners, will continue to advocate for CCCA’s passage.

Read our full Credit Card Competition Act issue brief here:

Full Expensing Tax Provision (100% Bonus Depreciation)

The Issue: Full expensing is a tax provision that allows businesses to immediately deduct the full cost of qualifying capital assets in the year they are purchased and placed into service. The provision was introduced in 2017 Tax Cuts and Jobs Act (TCJA) and began a five-year phase down period starting in 2023. Repeated studies have shown that full expensing permanence eliminates a structural tax bias against capital investment, allowing businesses to plan for long-term growth

The Legislation: In January 2025, the ALIGN Act (H.R. 574/S.187) was reintroduced by Rep. Jodey Arrington (R-TX) and Sen. James Lankford (R-OK). The legislation would reinstate and make full expensing a permanent tax tool for LBM dealers. H.R. 1 The One, Big, Beautiful Bill, Congress’ sweeping reconciliation bill, includes language that would reinstate full expensing through 2029.

NLBMDA Actions: While Congress has committed to reinstating full expensing, there remains disagreements among lawmakers surrounding the length of the provision. NLBMDA has been on Capitol Hill making the case for full expensing to be a permanent tax provision. During our spring legislative fly-in, NLBMDA called on members to make the pitch for full-expensing permanence, rather than a temporary reinstatement as proposed by the House.

Current Status: Full expensing began to phase down in 2023 and will expire completely in 2027 absent action from Congressional tax writers. NLBMDA continues to meet with Senate staff to advocate for the importance of full expensing and the positive impact permanence would have for LBM dealers. Read more from the Tax Foundation on the benefits of full expensing.

Section 199A of the Tax Cuts and Jobs Act

Introduced as part of the Tax Cuts and Jobs Act (TCJA), Section 199A provides a 20 percent deduction on qualified income for pass-through businesses, which account for 95 percent of all businesses and employ 63 percent of all private sector workers. This provision was designed to promote equity in America’s tax code by leveling the playing field between small businesses and larger corporations. Section 199A is estimated to have supported 2.6 million jobs, contributes $161 billion to employee compensation, and adds $325 billion to the national economy. Congress has the opportunity to permanently enact Section 199A by including the Main Street Tax Certainty Act (H.R. 703) in the tax reconciliation package.

The Death Tax Repeal Act of 2025

The Issue: The LBM industry is built upon family-owned businesses, whose owners spend their careers growing their companies with the intent of passing them on to the next generation. However, the federal estate tax, commonly referred to as the “death tax”, can place a financial burden on the next generation. Repealing the estate tax will provide much-needed relief to many LBM dealers, allowing them to preserve their legacies and pass on their businesses to future generations without facing substantial tax bills.

NLBMDA Actions: Estate tax reform is one of the leading tax provisions that NLBMDA has advocated for as Congress works on its sweeping tax reform bill. Earlier this year, NLBMDA joined coalition partners in formally asking Congress to take action to fully repeal the estate tax.

Current Status: Under TCJA, the estate tax exemption was doubled, providing more relief to small family-run businesses. However, if Congress does not act, this temporary increase in the exemption will expire on January 1, 2026, and the exemption will return to pre-TCJA levels. H.R. 1 The One, Big, Beautiful Bill, includes a provision that would permanently increase the tax exemption to $15 million, indexed for inflation each year after 2026. NLBMDA is meeting with Senate offices to ensure this new exemption makes it to the final bill while also renewing the call for a permanent repeal to be a continued priority for this Congress.

Forestry

Fix Our Forests Act

As evidenced by the recent wildfires in Southern California, there is an urgent need for federal policy reforms that would allow federal agencies to effectively collaborate to reduce wildfire risk. The Fix our Forests Act (H.R. 471) has bipartisan support and passed through the House of Representatives earlier this year. Contact your Senator and urge the Senate to take action.

Disaster Reforestation Act

The current tax code disadvantages forest landowners by restricting their ability to claim loss from destroyed timber, harming their ability to reforest lands. Timber typically takes 20 to 80 years to yield profit for the forester, making it extremely difficult to recover after a catastrophic loss. By providing for the equitable tax treatment of casualty loss of their timber crop when disaster strikes, this bill will foster stability and growth for foresters and in turn supports a robust timber industry in the United States.

Housing Construction Incentive Legislation

Affordable Housing Credit Improvement Act of 2025

Urge your Members of Congress to address the nation’s shortage of affordable housing by cosponsoring and passing the Affordable Housing Credit Improvement Act (H.R.2725, S.1515).

Neighborhood Homes Investment Act of 2025

Call your Member of Congress and encourage them to cosponsor the Neighborhood Homes Investment Act (NHIA). NHIA would establish a new tax incentive that is forecasted to drive the construction of more than 500,000 single-family homes over a ten-year period (H.R. 2854).

UNLOCK Housing Act

The Utilizing National Land for Opportunities and Community Key Housing Act would grant the Department of Interior the authority to sell or lease land to local governments for the purpose of developing housing.

Trade

Canadian Softwood Lumber

Since January, NLBMDA has sent letters to the White House and U.S. Trade Office urging the administration to adopt a trade policy which offers the industry long-term stability and price certainty.

Supply Chain & Workforce Development

LICENSE Act

Urge your Members of Congress to address the nation’s supply chain crisis and increase the number of available truck drivers by cosponsoring and passing the Licensing Individual Commercial Exam-takers Now Safely and Efficiently (LICENSE) Act (H.R. 623 / S. 191).

CONSTRUCTS Act

Contact your Member of Congress to call for legislation that would support the residential construction sector through the creation of a new competitive grant program that would bolster the workforce and address the shortage of skilled trades workers. Creating Opportunities for New Skills Training at Rural or Underserved Colleges and Trade Schools (CONSTRUCTS) Act of 2025 (H.R. 1055 / S.189).

|